- Discover it miles card vs capital one venture one plus#

- Discover it miles card vs capital one venture one free#

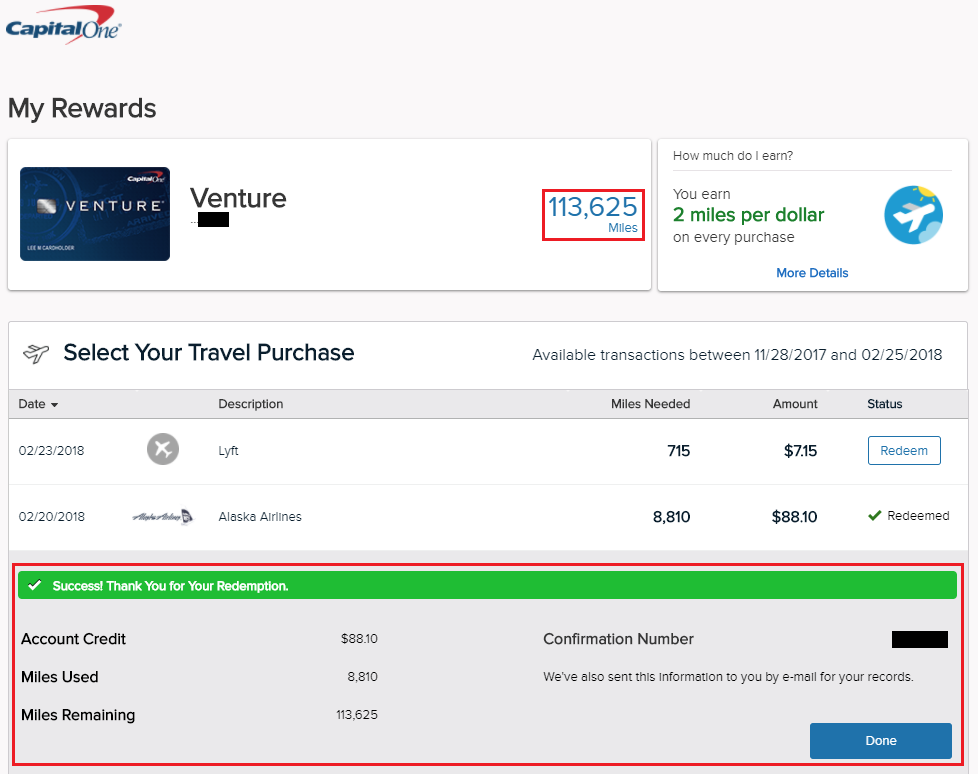

The Capital One® Venture card also is a great travel rewards card. Capital One Venture: Winner Depends on the Consumer

Discover it miles card vs capital one venture one plus#

The added flexibility of the Discover® it Miles card to earn rewards in more places, redeem them for cash, and get all first year miles doubled, plus the lower cost of ownership, make the it Miles card the clear winner here. No balance transfer or introductory purchase offer.2x miles for each $1 spent on travel and dining, but only 1 mile per $1 spent elsewhere.$0 annual fee in Year 1, $95 thereafter.The Chase® Sapphire Preferred rewards card offers a generous sign up bonus of 50,000 miles, if you spend $4,000 in your first three months.īesides that, the card’s fees are high and the opportunities to accumulate benefits are limited: Image courtesy Why We Prefer Discover it Miles over Chase Sapphire Preferred It turns out, Discover® also thinks those cards are good benchmarks, and provides a useful chart that we reprinted below.īoth CreditShout and Discover agree – after putting it through its paces, the Discover it Miles card will be the best travel rewards card of 2015 for most consumers.

In preparation of updating our Guide to Travel Rewards Cards (which was produced before the introduction of the Discover it Miles card), we decided to compare the it Miles card to the Chase® Sapphire Preferred and Capital One® Venture cards. After that, up to $37.ĭiscover it Miles vs. Greater of $10 or 5% of the amount of each cash advance This APR will vary with the market based on the Prime Rate. This APR will vary with the market based on the Prime Rate.Ģ6.74%. After that, your APR will be 13.74%-24.74%, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.ġ0.99% intro APR for 14 months from date of first transfer, for transfers under this offer that post to your account by August 10, 2018. Fees and Interest RatesĪs mentioned previously, the Discover® it Miles card has no annual fee and an introductory APR for new purchases of 0%.Ġ% intro APR for 14 months from date of account opening. The loss of these perks does not affect our review.

Discover it miles card vs capital one venture one free#

Flight accident insurance insures you and your covered dependents in the event of a accidental death (up to $500,000).No blackout dates when redeeming miles.Annual credit up to $30 for in-flight wi-fi purchases.Option to redeem your rewards as 1.5% cash back, not just as airline tickets, hotel rooms, car rentals, travel agents, online travel sites and commuter transportation.In addition to those first year perks, a Discover® it Miles travel rewards card offers these great benefits: After the first year, a variable APR applies. 0% Intro APR on purchases for 14 Months.That is equivalent to giving you 3 miles for each $1 spent in Year 1. At the end of your first year, Discover® will double all the miles you earned. New cardholders are entitled to some great rewards and benefits during their first year, namely: The Discover® it Miles credit card offers some significant rewards and benefits, especially for a card that does not carry an annual fee. Discover it Miles Key Features and Benefits

0 kommentar(er)

0 kommentar(er)